Savings may be substantial if the debt was transferred from a high-interest credit card to one with a lower interest

It's not enjoyable to have student loan debt. It's time to consider ways to pay off your student debts more

For many people, purchasing a home is a life-changing investment. It's also capable of being a challenging problem. There is

When you get a mortgage to buy a home, you have to pay back both the amount you borrowed (called

A wraparound mortgage is a unique way to pay for a home. It lets the buyer take over the seller's

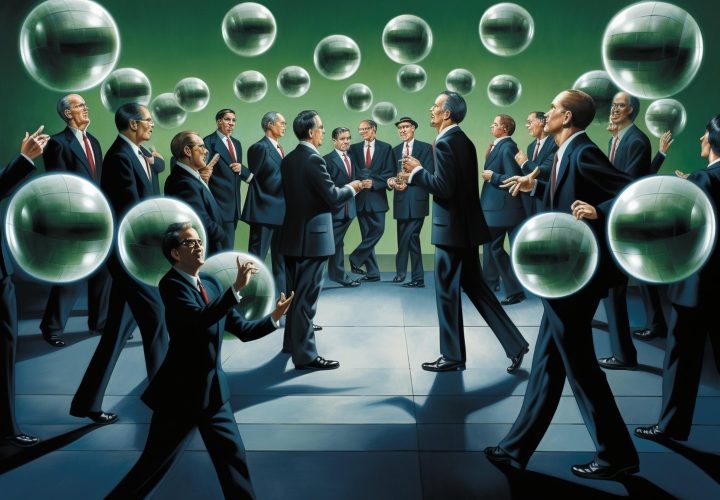

Have you ever thought about making an investing choice that goes against what most people do? This practice, which seems

Mutual funds have a lot of confusing terms, fees, and secret costs that can make you feel like you're in

Holders of variable-rate mortgages used to be better off financially than those with fixed-rate mortgages. That's because they lived through

A tax-free savings account (TFSA) is a type of savings account available in Canada. It allows individuals to make contributions

Many confuse multiple forms of pensions: saving during one's career and receiving a steady income in retirement. Due to their