For many people, purchasing a home is a life-changing investment. It's also capable of being a challenging problem. There is

When you get a mortgage to buy a home, you have to pay back both the amount you borrowed (called

A wraparound mortgage is a unique way to pay for a home. It lets the buyer take over the seller's

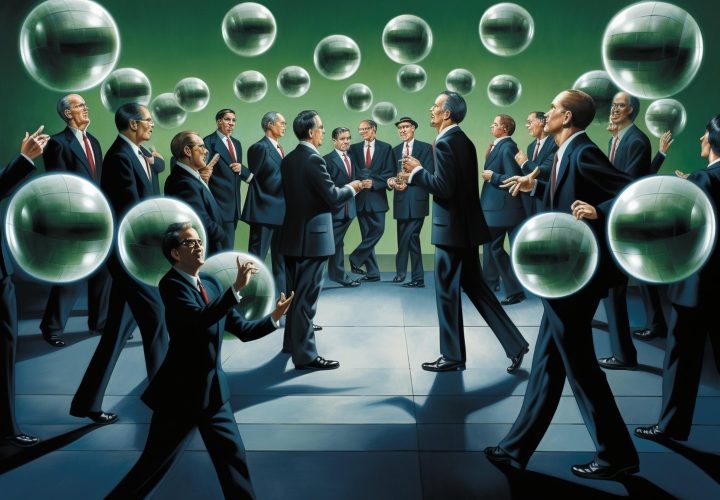

Have you ever thought about making an investing choice that goes against what most people do? This practice, which seems

Mutual funds have a lot of confusing terms, fees, and secret costs that can make you feel like you're in

Holders of variable-rate mortgages used to be better off financially than those with fixed-rate mortgages. That's because they lived through

A tax-free savings account (TFSA) is a type of savings account available in Canada. It allows individuals to make contributions

Many confuse multiple forms of pensions: saving during one's career and receiving a steady income in retirement. Due to their

Whether you are applying for your first mortgage or looking to renew your current one, you have options. Which type

Mortgages are one factor that weighs significantly in the cost of living for many people worldwide. With urbanization and the